Mastering the Stock Market: Strategies for Equity Trading Success 📈💼

The stock market represents one of the most powerful wealth-building tools available to investors and traders. With proper knowledge, strategy, and discipline, anyone can participate in the growth of global economies and successful companies.

🔹 Understanding Stock Market Fundamentals

Stocks represent ownership shares in publicly traded companies. When you buy a stock, you're buying a piece of that company. Key concepts every trader must understand:

- Market Capitalization: Total value of a company's outstanding shares

- Volume: Number of shares traded in a given period

- Bid-Ask Spread: Difference between buying and selling prices

- Market Hours: 9:30 AM to 4:00 PM EST (US markets)

🔹 Essential Stock Trading Strategies

1. Value Investing 💎

Buy stocks trading below their intrinsic value. Popularized by Warren Buffett, this strategy focuses on finding undervalued companies with strong fundamentals. Requires patience and thorough fundamental analysis.

2. Growth Investing 🚀

Invest in companies with above-average growth potential, even if they appear expensive. Focus on earnings growth, revenue growth, and market expansion. Higher risk but potentially higher returns.

3. Momentum Trading ⚡

Buy stocks that are already moving up and sell when they show signs of weakening. Based on the principle that winners tend to keep winning. Requires active monitoring and quick decision-making.

4. Swing Trading 🌊

Hold positions for several days to weeks to capture medium-term price movements. Combines technical analysis with market timing. Less stressful than day trading but more active than long-term investing.

5. Day Trading 📊

Buy and sell stocks within the same trading day. Requires deep market knowledge, quick reflexes, and strict risk management. Not recommended for beginners due to high risk and complexity.

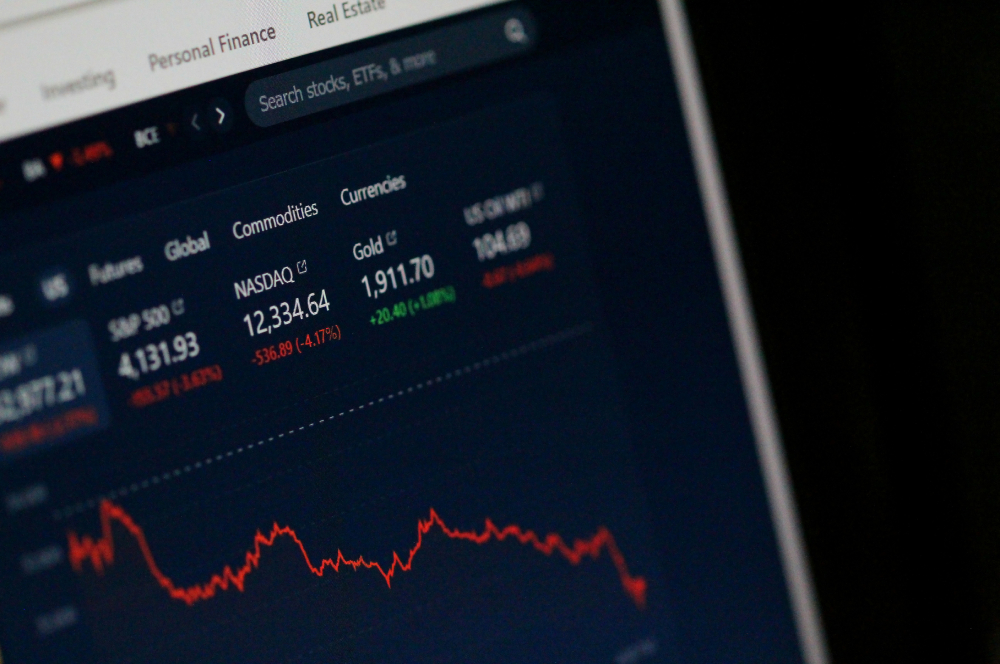

🔹 Key Market Indicators to Watch

Successful traders monitor these indicators to gauge market health and direction:

- S&P 500: Broad market index representing 500 large US companies

- VIX (Volatility Index): "Fear index" - measures market volatility

- Dow Jones Industrial Average: 30 major US companies

- NASDAQ Composite: Tech-heavy index with over 3,000 stocks

- Interest Rates: Set by Federal Reserve, impact stock valuations

🔹 Risk Management in Stock Trading

Protecting your capital is paramount. Implement these risk management rules:

- Position Sizing: Limit each position to 2-5% of your portfolio

- Stop-Loss Orders: Automatically sell if price drops to predetermined level

- Diversification: Spread investments across different sectors

- Asset Allocation: Balance stocks with bonds and other assets

📌 Pro Tip: Always do your own research (DYOR). Read company financials, understand their business model, and know their competitive advantages before investing.

💡 The stock market rewards patient, disciplined investors who combine fundamental analysis with technical insights. Remember: time in the market beats timing the market!

Learn, Trade, And Grow With Our Trading Floor & Signal Rooms.

Join Us Now