Navigating the Crypto Market: Strategies for Digital Asset Trading 🚀💰

The cryptocurrency market has revolutionized the financial landscape, offering unprecedented opportunities for traders worldwide. Unlike traditional markets, crypto operates 24/7, providing continuous trading opportunities across thousands of digital assets.

🔹 Understanding the Crypto Market Dynamics

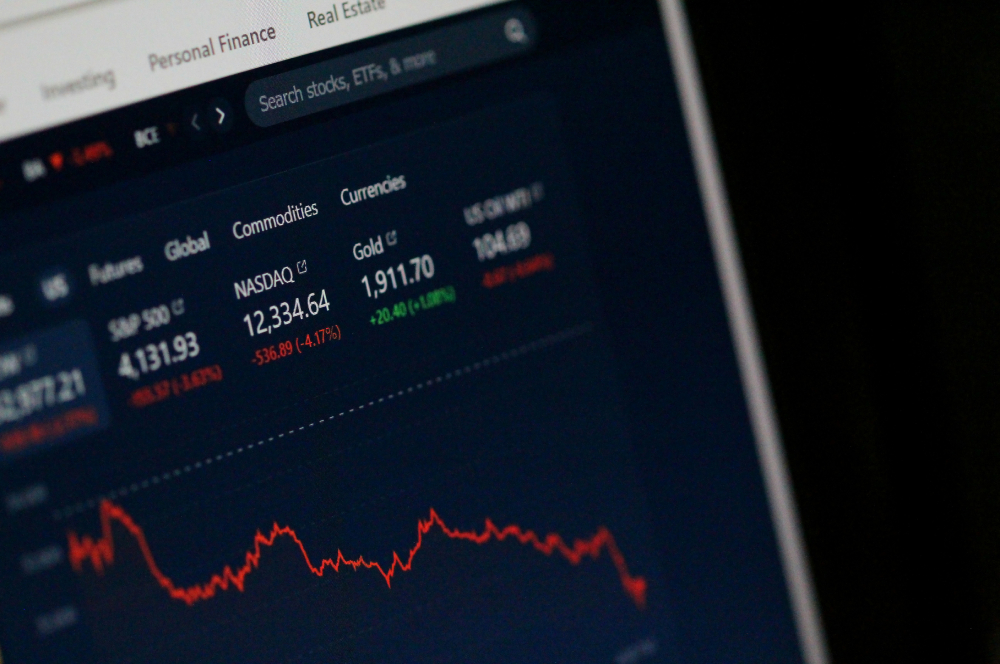

Cryptocurrency markets are characterized by extreme volatility, high liquidity, and rapid price movements. Key factors influencing crypto prices include:

- Market Sentiment: Social media trends and news coverage can dramatically impact prices

- Regulatory News: Government announcements and policy changes

- Technological Developments: Network upgrades, partnerships, and innovations

- Macroeconomic Factors: Inflation rates, interest rates, and economic policies

🔹 Essential Trading Strategies

1. Day Trading 📈

Execute multiple trades within a single day to capitalize on small price movements. Requires constant monitoring and quick decision-making. Best suited for major cryptocurrencies like Bitcoin and Ethereum with high liquidity.

2. Swing Trading 🌊

Hold positions for several days to weeks to capture medium-term price movements. Less time-intensive than day trading and allows for more thorough analysis. Ideal for traders who can't monitor markets constantly.

3. Position Trading 📊

Long-term strategy holding positions for months to years based on fundamental analysis. Requires strong conviction in project fundamentals and patience to weather market volatility.

4. Arbitrage Trading ⚡

Exploit price differences across exchanges. Buy low on one exchange and sell high on another simultaneously. Requires fast execution and accounts on multiple platforms.

🔹 Risk Management in Crypto Trading

Crypto markets can be unforgiving. Implement these risk management techniques:

- Position Sizing: Never risk more than 1-2% of your trading capital on a single trade

- Stop-Loss Orders: Automatically exit losing positions at predetermined levels

- Take-Profit Targets: Lock in profits at predefined price levels

- Diversification: Spread risk across multiple cryptocurrencies

🔹 Technical Analysis Tools for Crypto

While crypto has unique characteristics, traditional technical analysis remains valuable:

- Support and Resistance Levels: Key price levels where buying/selling pressure emerges

- Moving Averages: Identify trends and potential reversal points

- RSI and MACD: Momentum indicators for overbought/oversold conditions

- Volume Analysis: Confirm price movements with trading volume

📌 Pro Tip: Use multiple timeframes for analysis. Daily charts for trend direction, 4-hour charts for entry points, and 15-minute charts for precise timing.

💡 The crypto market rewards prepared traders who combine technical analysis with fundamental research and disciplined risk management. Stay informed, stay patient, and never stop learning!

Learn, Trade, And Grow With Our Trading Floor & Signal Rooms.

Join Us Now